HEALTH CARE REAL ESTATE ACQUISITIONS

& 1031 TAX-DEFERRED EXCHANGES

The Healthcare Real Estate sector is built to succeed and supported by strong fundamentals including long-term leases, specialized build-outs, stable occupancy, and high-performing tenants, all of which are bolstered by growing demand for healthcare services.

1031 Exchange investors have long favored the stability of high-quality tenants and predictable income generated from Healthcare Real Estate properties. Pharmacies, Medical Office, Urgent Care, Ambulatory Care, Dialysis Centers, Long Term Care, and Senior Care all offer unique opportunities to investors looking to exchange into their first healthcare property or expand and diversify their portfolio.

The healthcare industry is an undeniable force in the U.S. economy. Even post-pandemic as the sector is challenged by uncertainty in healthcare regulations and the pressure on healthcare providers to become more efficient, lower costs, and improve quality of care, the healthcare industry continues to grow at a steady pace.

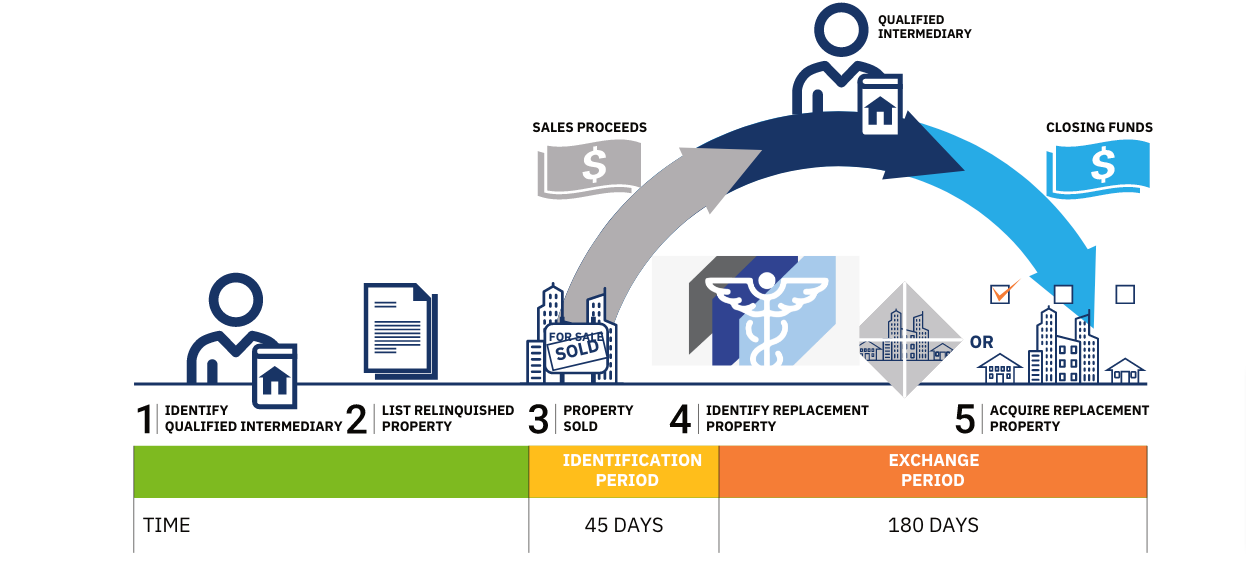

Meet Your 45 Day Tax-Deferred Exchange Replacement Requirements

WHY HEALTHCARE NET LEASES ARE PREFERRED BY TENANTS & INVESTORS

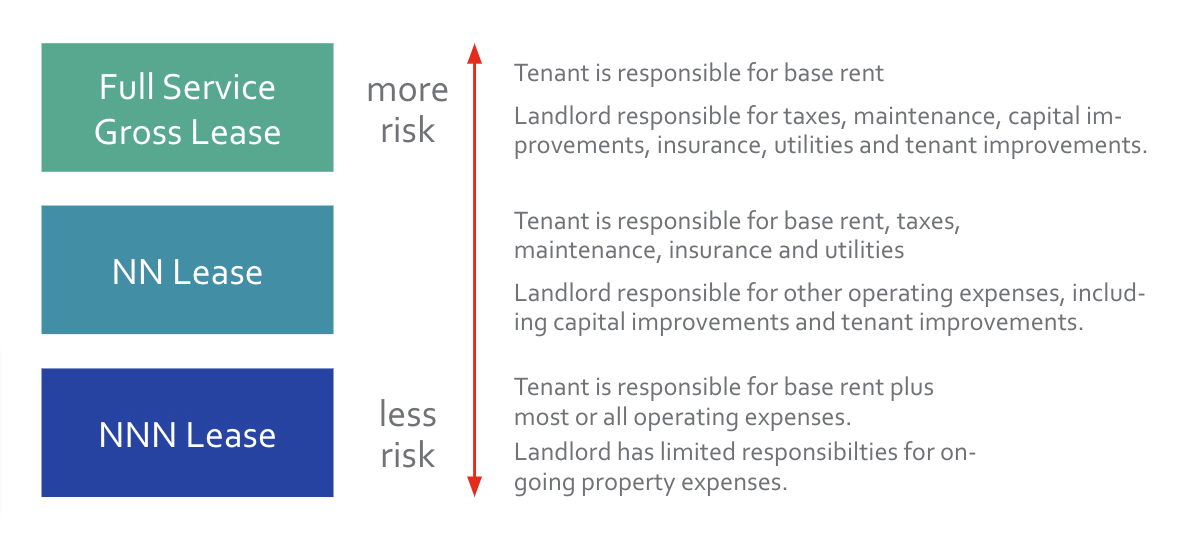

A triple net lease (NNN) requires the tenant to pay a base rent, plus most of the property expenses, including taxes, insurance, utilities, and capital improvements. This NNN structure helps the property owner avoid many unforeseen property maintenance expenses and, in turn, helps provide consistency in revenue.

Net and gross leases refer to whether the base rent includes operating costs.

The type of lease established between a tenant and the property owner determines whether the tenant or owner is responsible for the property management expenses. With a net lease, the tenant (not the owner) is responsible for paying the majority of operating expenses. Property operating expenses may include:

– Building taxes

– Insurance

– Utilities

– Maintenance expenses

– Capital improvements

– Tenant improvements

With a gross lease, the tenant pays a lump sum, which typically includes additional expenses in the rent.

Net lease healthcare real estate properties are simple to understand, provide long-term predictable rental income, and are abundantly available across the country. Net Lease properties are typically stand-alone hard-assets with a single tenant. Very often healthcare businesses rent rather than build or buy their place of business, allowing them to focus on running their business rather than managing real estate.

Why do healthcare companies lease real estate vs own and manage it themselves?

For businesses, leasing commercial real estate has significant financial benefits:

- Leasing allows a business to focus on what it knows best – operating its business. Commercial real estate is a capital-intensive hard asset. Most businesses would rather focus on improving their unique goods and services rather than repair and maintenance.

- Leasing is less capital-intensive than purchasing. A business which has constraints on its capital may be able to grow its core business activity more rapidly if it leases property rather than purchasing the property outright.

- Property values fluctuate. Leasing shifts that downside risk to the lessor/owner, but if the property market has shown steady growth over time, a business that depends on leased property is sacrificing the potential for gains based on the appreciation in the property.

- Leasing may provide more flexibility. An evolving and growing business that expects to relocate to a new facility in the relatively short term is not obliged to renew a lease at the end of its term.

- Leasing may be the only practical option. For example, a business that wishes to locate in a large office building within tight locational parameters may find leasing better suited to its real estate budget.

- Potential tax advantages. Depreciation of owned capital assets has different tax and financial reporting treatment from ordinary business expenses. Unlike depreciation, lease payments are considered expenses, which can be fully set off against revenue on a current basis when calculating taxable profit at the end of the relevant tax accounting period.

Healthcare is the largest employer in the U.S.

The U.S. healthcare industry is one of the largest and most complex in the world. More than 20 million Americans are employed in healthcare and social assistance, a growth rate of 23 percent in the last decade (+3.8 million jobs) according to the Bureau of Labor Statistics.

The healthcare sector represents roughly 13.4 percent of all employment nationally. Even more remarkably, the healthcare sector was responsible for 16.9 percent of all job creation in the last decade. Healthcare employment is enjoying faster growth than any other sector in the U.S. workforce

The rise of healthcare spending in the U.S. economy

Healthcare is also one of the fastest growing industries in the U.S. economy. Healthcare spending grew to nearly $3.5 trillion in 2017. According to the U.S. Centers for Medicare & Medicaid Services, national healthcare expenditures are projected to grow to $5.7 trillion by 2026, representing an average annual rate of growth of 5.5 percent, reaching a projected 19.7 percent of GDP in 2026. Healthcare spending is expected to grow by more than $2 trillion annually in the next decade.

A growing and aging U.S. population is driving healthcare demand

Despite a recent slowing trend, the U.S. population is projected to grow by an average of 2.3 million people per year until 2030. By 2060, the U.S. is projected to grow by 79 million people. During that same period, the American population over 65 years of age is projected to almost double, from 50 million to nearly 95 million, while the 85 and older population is expected to nearly triple, from 6.5 million to 19 million.

The aging U.S. population has a direct effect on the demand for healthcare as doctor visits and medical expenses dramatically increase with age.

Global Health Crisis Amplifies Needs

MEDICAL OFFICE

MEDICAL OFFICE

Investors continue to view Medical Office Buildings (MOB) as a favored asset class, given the sustained strong fundamentals of medical office leasing, and healthcare demographics in general. The overall strength in market conditions is a continuation of a low-interest-rate environment, the ability of investors to raise massive levels of new investment dollars, as well as a limited supply of good-quality MOB product available for sale.

As demand for outpatient care has steadily risen, so have MOB fundamentals. Occupancy has held consistently between 92.0 percent and 92.5 percent for the last several years. Steady demand kept net operating income stable through the recession and has kept Net Operating Income growth trending upward in recent years. Rising investor confidence in the MOB segment has driven increased transaction value ($9.8 billion in 2018) while construction has kept pace with demand.

Medical Office Buildings’ performance reflects sector vitality despite economic uncertainty and the political focus on changing healthcare regulation, medical office real estate continues to perform well across nearly all U.S. markets. MOBs account for approximately 10 percent of the U.S. office sector; they are typically smaller single-tenant and multi-tenant buildings. From large healthcare systems to small, independent physician practices, these high-credit quality tenants are fueling demand for this growing sector.

Cap Rates average 6.5% for medical office properties across the U.S. adjusted for lease length, tenant, and location. Medical Office Leases with 11-15 years remaining average 6.35%, 6-10 years remaining averaged 6.60% and under 5 years remaining averaged 7.4%.

Asking sales price for MOBs range from $1.5-$10 million.

PHARMACIES

PHARMACIES

Pharmacies with long-term investment-grade tenants such as CVS, Walgreens, and non-investment-grade tenants such as Rite Aid continue to be one of the preferred vehicles of choice for Tax Deferred Exchanges. Amidst the pandemic investors are looking to single-tenant and net-lease (STNL) properties because of their reliable cash flow and traditionally longer lease terms. Single-tenant net lease assets smooth out volatility and create predictability in a portfolio, and noted that from 2020 into the first half of this year, retail accounted for 20% of all investment in the STNL space, as opposed to 31% coming out of the Great Financial Crisis. Pharmacy pricing is strongest within the STNL retail sector and is outperforming the broader retail market.

This increased demand had brought CVS and Walgreen to near historic cap rate levels as they are deemed essential retail. The supply of drug stores with long-term leases remains low compared to historical standards mainly due to the lack of new store development. Pharmacies throughout the U.S. are the preferred healthcare real estate tenant for conservative investors offering some of the longest NNN leases to investment grade tenants.

Cap rates in the single-tenant pharmacy sector are at historic lows. The two largest tenants in the space CVS and Walgreens are both investment grade credit. Leases with 15-19 years remaining average 4.95%-5%, with 10-14 years 5.30%-5.4%, with 6-9 years 6.00%-6.5%, 6-9 years 6.00%-6.50%, with 5 years and under average 6.665-7.25%.

Pharmacies are currently available across the U.S. with asking prices ranging from $1.5-$10 million

SPECIALTY CARE

SPECIALTY CARE

The trend of outpatient specialty care continues to increase the demand for healthcare system specific facilities.

Ambulatory surgery centers (ASCs) are healthcare facilities that offer patients the convenience of having surgeries and procedures performed safely outside the hospital setting. Since their inception more than four decades ago, ASCs have provided new opportunities to improve quality and patient care while simultaneously reducing costs. Nearly two-thirds of ASCs are single specialty. Gastroenterology, ophthalmology, and pain management are the leading specialties, offering endoscopy and colonoscopy, cataract and vision correction surgery, and pain management procedures, respectively.

Dialysis clinics, dental clinics, and urgent care centers have always been the closest thing to a commodity asset within the healthcare net lease sector, but in the past few years, dialysis product has separated itself from the pack. Although there has been some consolidation within the dental and urgent care spaces, those sectors remain fragmented. The dialysis industry, however, features two primary players and one secondary operator – the two behemoths in this space are DaVita Kidney Care and Fresenius Medical Care, with U.S. Renal Care being the smaller, yet still significant, third operator.

Institutional and private investors continue to seek investment opportunities within the single-tenant medical sector. Long-term leases to the larger credits in the sector (hospital systems and Fresenius/DaVita) will generate the lowest cap rates within the medical sector.

1031 and private buyers are the primary buyers of these assets due to the cap rates associated with these properties. Investor demand for the single tenant net lease medical sector will remain strong. The long-term outlook for this asset class combined with the expansion of medtail real estate will create a steady pipeline of property supply for investors. The net lease medical sector will continue to provide investors protection from e-commerce and inflation as many medical leases have structured rental escalations throughout the term of the lease.

SENIOR CARE

SENIOR CARE

The senior care sector consists of long-term care facilities such as memory care, transition care, assisted living, and senior living are all particularly proving their resilience coming out of the pandemic.

The rate at which American Seniors are retiring is truly staggering. The number of Americans 65 and older will increase from 56 million in 2020 to 79.2 million by 2035, due to the emergence of Baby Boomers into the age of retirement. Such a vast increase only creates a greater demand for Senior Living Facilities. As the elderly population grows, the rate of senior housing new construction is not keeping pace. When these two dynamics are combined, the need that is left unaddressed is the growing market for newer and better facilities/communities tailored to emerging senior care needs.

The senior care sector has long been dominated by institutional investors. The sector has been traditionally difficult for 1031 Tax-Deferred Exchange Investors to enter due to the complexity of operator structures. To overcome this some senior care sponsors are offering opportunities for fractional ownership via a Delaware Statutory Trust (DST) structure. This allows for 1031 exchange investors to participate in the sector while leveraging the sponsor’s operations team.

A FOCUS ON INCOME PRODUCING PROPERTIES

LEASED TO HEALTHCARE PROVIDERS

Acquisitions & 1031 Exchange

Healthcare1031 & HealthcareNetLease Direct & Whole Ownership custom acquisition solutions and buyer representation are exclusively provided by Investment Grade Income Property, LP

Healthcare1031 does not offer legal or tax advice. Tax topics discussed are for educational purposes only and should not be considered professional tax advice. It’s recommended that you discuss your situation with your tax or legal advisor