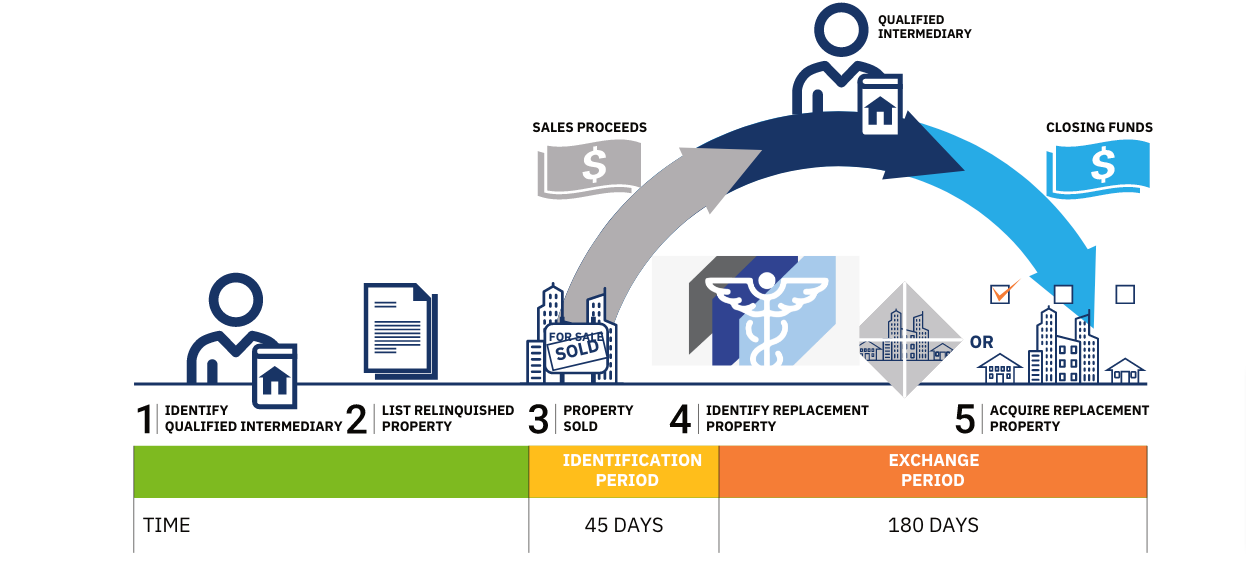

The 1031 “like-kind” exchange is a tool that allows a real estate holder to defer capital gains (and recapture) taxes on the sale of a property when those proceeds are subsequently invested in another like-kind property.

1031 refers to the IRS code that spells out the law and specific requirements regarding such “like-kind” transactions. The IRS is taking the view that any investment proceeds that are rolled (exchanged) into another “like-kind” investment within a certain time frame, are not actually recognizing a “gain” (profit) which would be subject to capital gains taxes.

In addition to deferring capital gains, the 1031 exchange may also allow the seller of a property to defer depreciation recapture taxes.

DST STRUCTURE BENEFITS

While the use of the 1031 has been a staple for investors for some time, the use of the Delaware Statutory Trust provides investors with greater flexibility in terms of real estate investment choices for those that would like to use the 1031 exchange.

From the perspective of an individual investor, perhaps the biggest benefit of the DST structure is that it allows a fractional interest in real estate interests to qualify as a like kind property for exchange purposes. In turn, this opens up a number investment possibilities that may not have been available to the investor. An investor who owned and managed residential properties for example may roll the proceeds from the sale of that property, into a new healthcare 1031 class such as senior care through the purchase of a fractional investment.

Not only does the DST open up new sectors that may not have been available, but the structure will allow an investor to become a passive investor, and not have to worry about the day to day issues of real estate management.

While it is always possible to hire someone to manage your properties as an individual investor, when you invest as part of a DST, the management the trust will be fully handled by the sponsor and their team. This also applies to the work and analysis done by professionals associated with the trust regarding investment and financing decisions.

How does a Delaware Statutory Trust Work?

Generally speaking a sponsor will set up the DST and name trustee(s) who will have sole authority to manage the business and assets of the trust. The trustees will have a fiduciary responsibility to the beneficial owners (i.e. fractional owners).

The trust will collect the investment money, arrange any financing necessary on behalf of the trust, and make and manage or hire property managers. The trust itself holds direct ownership of the assets with the individual owners owning an interest (or share) in the trust.

Similar to an LLC all income and distributions are passed through and taxed to the individual owners. The typical life of a trust can vary greatly but could easily be five to ten years in which property is acquired, income collected and distributed to owners and when, upon disposition of assets, remaining capital is returned to investors.

SENIOR CARE

The senior care sector consists of long-term care facilities such as memory care, transition care, assisted living, and senior living are all particularly proving their resilience coming out of the pandemic.

The rate at which American Seniors are retiring is truly staggering. The number of Americans 65 and older will increase from 56 million in 2020 to 79.2 million by 2035, due to the emergence of Baby Boomers into the age of retirement. Such a vast increase only creates a greater demand for Senior Living Facilities. As the elderly population grows, the rate of senior housing new construction is not keeping pace. When these two dynamics are combined, the need that is left unaddressed is the growing market for newer and better facilities/communities tailored to emerging senior care needs.

The senior care sector has long been dominated by institutional investors. The sector has been traditionally difficult for 1031 Tax-Deferred Exchange Investors to enter due to the complexity of operator structures. To overcome this some scenario care sponsors are offering opportunities for fractional ownership via a Delaware Statutory Trust (DST) structure. This allows for 1031 exchange investors to participate in the sector while leveraging the sponsor’s operations team.

Healthcare Net Lease Direct Ownership custom acquisition solutions and buyer representation are exclusively provided by Investment Grade Income Property, LP dba HealthcareNetLease.com & Healthcare1031.com.

Healthcare1031 does not offer legal or tax advice. Tax topics discussed are for educational purposes only and should not be considered professional tax advice. It’s recommended that you discuss your situation with your tax or legal advisor

Senior Living Fractional Ownership & DST solutions are offered exclusively direct by the sponsor SLF 1031, LLC.

The purpose of this webpage is to provide general information about senior housing, the senior housing 1031 market ; it is not intended as either an offer to sell or solicitation of an offer to buy securities in SLF1031, LLC.

Statements, descriptions, and data on this page are for informational purposes only and relate to an investment opportunity which may be offered in the future. No offer or solicitation will be made until the necessary final documentation and agreements have been delivered to you. Forward Looking Statements. The Fund is including the following cautionary statement in this executive summary to make applicable and take advantage of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 for any forward-looking statements made by, or on behalf of, the Fund. Forward-looking statements include statements concerning plans, objectives, goals, projections, strategies, future events or performance, and underlying assumptions and other statements which are other than statements of historical facts. All such subsequent forward-looking statements, whether written or oral and whether made by or on behalf of the Fund, are also expressly qualified by these cautionary statements. Certain statements contained herein, including, without limitation, those that are identified by the use of the words “anticipates,” “estimates,” “expects,” “forecasts,” “intends,” “plans,” “predicts,” “projects,” “believes,” “seeks,” “will,” “may” and similar expressions, are “forward-looking statements” as defined by the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve risks and uncertainties, which could cause actual results or outcomes to differ materially from those expressed in the forward-looking statements. The Fund’s expectations, beliefs and projections are expressed in good faith and are believed by the Fund to have a reasonable basis, but there can be no assurance that management’s expectations, beliefs or projections will result or be achieved or accomplished