A Delaware Statutory Trust or DST is a separate legal entity created as a trust under Delaware Statutory Law. A DST allows you to co-invest with other investors in one or numerous properties. Although DSTs aren’t new, current tax laws have made them popular among 1031 exchange investors.

Purchasing into a Delaware Statutory Trust is treated as a direct interest in real estate; you are assigned fractional ownership of equity and debt, fulfilling your exchange requirements. Minimum investments are typically between $25,000 and $100,000; therefore, a single investor may own a fractional interest in an entire property or portfolio and receive distributions from the operation of the trust, from rental income, and the eventual sale of the assets.

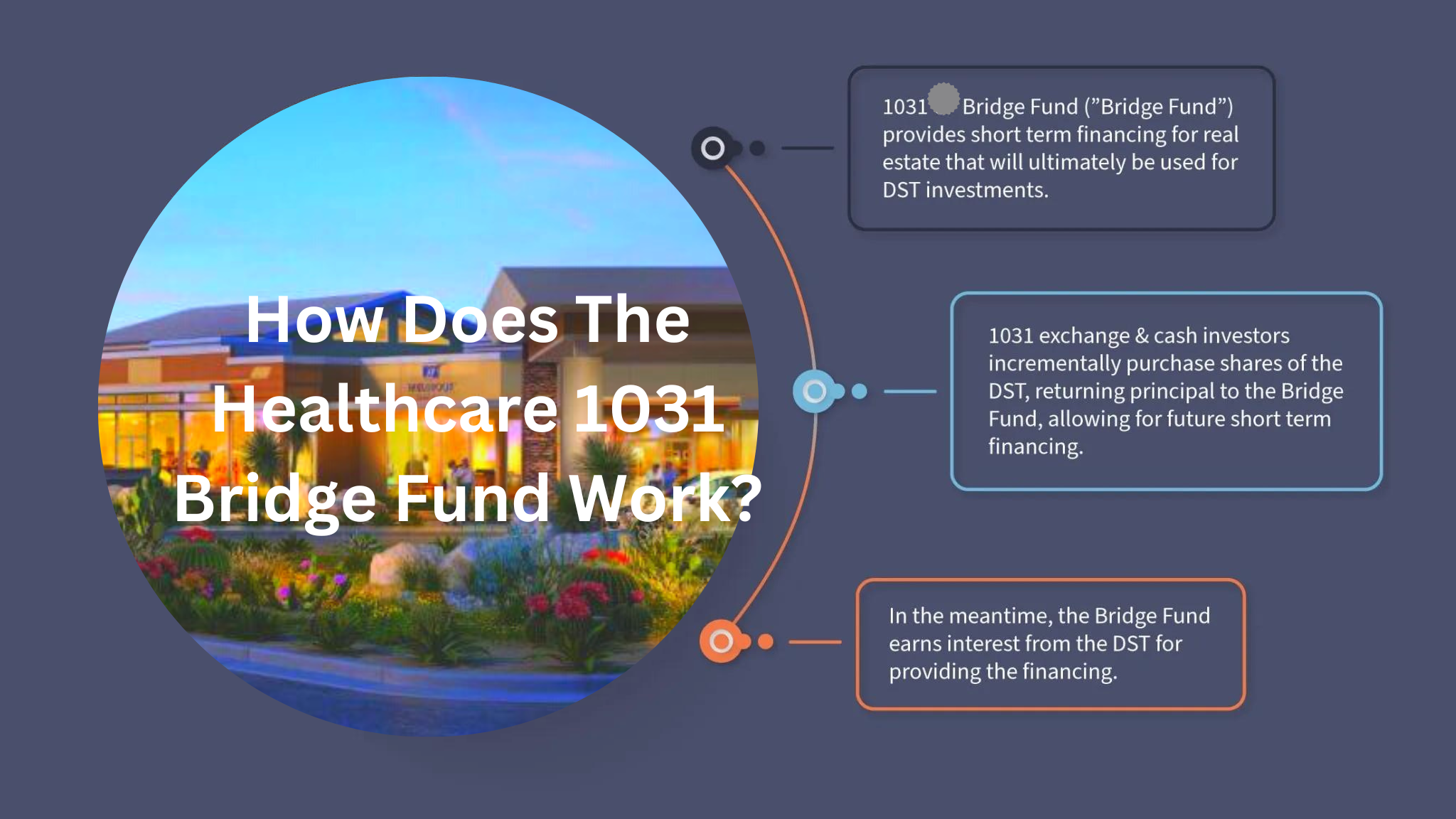

The principal objectives of the Bridge Fund will be to: (1) provide Investors with current income in the form of interest payments from available net cash flow generated by Bridge Fund investments, and (2) return Investors’ principal upon maturity. There is no assurance that either of these objectives will be achieved.

The Bridge Fund is offering to sell senior secured promissory notes maturing in 24 months, subject to the Manager’s right to extend the maturity of the Notes for up to three successive one-year terms, up to an aggregate $25,000,000 in Notes, upon the terms and conditions stated in the Private Placement Memorandum (“PPM”).

The Offered Securities are being issued with a minimum investment of $25,000 and in additional denominations of $1,000; however, the Manager has the right, in its sole discretion, to waive the minimum purchase requirement.

The promissory notes are senior, secured obligations of the Fund, bearing non-compounding interest at the rate of 9% per annum.